wichita ks sales tax rate 2019

The average total salary of Retail Sales Associates in Wichita KS is 23500year based on 114 tax returns from TurboTax customers who reported their occupation as retail sales associates in Wichita KS. The minimum combined 2022 sales tax rate for Wichita Kansas is.

What Is The Nrst Quoted Tax Rate Download Table

114 full-time salaries from 2019.

. Sales tax collected and spent on MO expenses in 2018. Aug 18 2021 des moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. The Kansas state sales tax rate is currently.

These are for taxes levied by the City of. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. Earn what you deserve.

Has impacted many state nexus laws and sales tax. The most populous location in Wichita County Kansas is Leoti. The Kansas use tax should be paid for items bought tax-free over the internet bought.

This is the total of state county and city sales tax rates. 2022 Kansas state use tax. 100 US Average.

One according to Mark Manning the citys budget officer is that the city has borrowed money with proceeds from the sales tax pledged for repayment. 3 lower than the maximum sales tax in KS. 100 US Average.

Total Property Tax Rate. There are a total of 531 local tax jurisdictions across the state collecting an average local tax of 1979. You may use the chart or compute the tax due by applying the state and local sales tax rate in effect for your address to the total purchases subject to the tax.

Thats an increase of 1431 mills or 457 percent since 1994. It pledges half the citys share of the sales tax towards property tax reduction. If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636.

A week after approving a 22 hike that customers will pay for a natural gas franchise tax For the second meeting in a row the Wichita City Council approved a 27 sales tax increase in the development around the new baseball stadium and on the east bank of the Arkansas River including the Boathouse and Waterwalk developments. Wichita KS Sales Tax Rate. Above 100 means more expensive.

There is no applicable city tax or special tax. This rate is the sum of the state county and city tax rates outlined below. Outlook for the 2021 Kansas income tax rate is to remain unchanged as the scheduled income tax.

The Wichita sales tax rate is. Second there is a Wichita city ordinance number 41-185. USD 259 Wichita Schools.

3 Local Sales Tax Distribution of Revenue. Winfield KS Sales Tax Rate. Click here for a larger sales tax map or here for a sales tax table.

You can find more tax rates and allowances for Wichita County and Kansas in the 2022 Kansas Tax Tables. About our Cost of. A full list of these can be found below.

Kansas income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020. Divide Line 15 by Line 23 and multiply by 10018 0706083100 25. The minimum combined 2022 sales tax rate for Wichita County Kansas is.

Taxes in Wichita Kansas are 142 cheaper than Andover Kansas. You can print a 75 sales tax table here. Topeka KS Sales Tax Rate.

The average cumulative sales tax rate between all of them is 85. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. As of 2019 946 of Wichita KS residents were US citizens which is higher than the national average of 934.

In 2019 it was 32721 based on the Sedgwick County Clerk. How Does Sales Tax in Wichita County compare to the rest of Kansas. The 2018 United States Supreme Court decision in South Dakota v.

And pledges the remaining. The City of Wichita property tax mill levy rose for 2019. The Kansas sales tax rate is currently.

The County sales tax rate is. Taxes in Salina Kansas are 19 more expensive than Wichita Kansas. City of Wichita Falls Taxing Unit Name Phone area code and number Taxing Units Address City State ZIP Code Taxing Units Website Address.

The KS use tax only applies to certain purchases. Lower sales tax than 73 of Kansas localities. 2020 rates included for use while preparing your income tax deduction.

What is the sales tax rate in Wichita Kansas. The most populous zip code in Wichita County Kansas is 67861. Average Sales Tax With Local.

This is the total of state and county sales tax rates. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. The Wichita County sales tax rate is.

31 rows The latest sales tax rates for cities in Kansas KS state. Below 100 means cheaper than the US average. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr.

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. And local sales tax rate for Finney County outside the city limits of Garden City is 795. Tax on your untaxed out-of-state purchases made during calendar year 2019 refer to the instructions for line 20 of Form K-40.

The sales tax rate does not vary based on location. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was 31290. Sedgwick County Appraiser website.

In 2022 the minimum combined sales tax rate within Wichita Kansas 67202 zip codes is 75. As of the 2020 census the population of the city was. 2019 effective tax rate.

PDF to see established fees and charges effective October 2019. Rates include state county and city taxes. Collect Retailers Sales Tax.

Iowa also 1 percent. About our Cost of. Enter amount from full year.

The Kansas use tax is a special excise tax assessed on property purchased for use in Kansas in a jurisdiction where a lower or no sales tax was collected on the purchase. Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. Dont know your sales tax rate.

Effective Tax Rates for Retail Sales Associates in Wichita KS. 1-22 2 KANSAS SALES TAX. 142063 mills 2018 City.

The sales tax rate does not vary based on zip code. The 65 state plus a 145. The highest Kansas tax rate increased from 52 to 57 in 2018 up from 46 for the 2016 income tax year.

Above 100 means more expensive. Kansas Department of Revenue website. Below 100 means cheaper than the US average.

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Sales Tax On Cars And Vehicles In Kansas

Kansas Food Sales Tax Kc Healthy Kids

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Is One Of The Least Tax Friendly States In The Us Kake

Kansas Food Sales Tax Kc Healthy Kids

Dodge City Sales Tax Dodge City Use Tax Dodge City Cpa

Gov Laura Kelly Promises To Sign Bipartisan Bill Eliminating Kansas Sales Tax On Food By 2025 Kansas Reflector

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

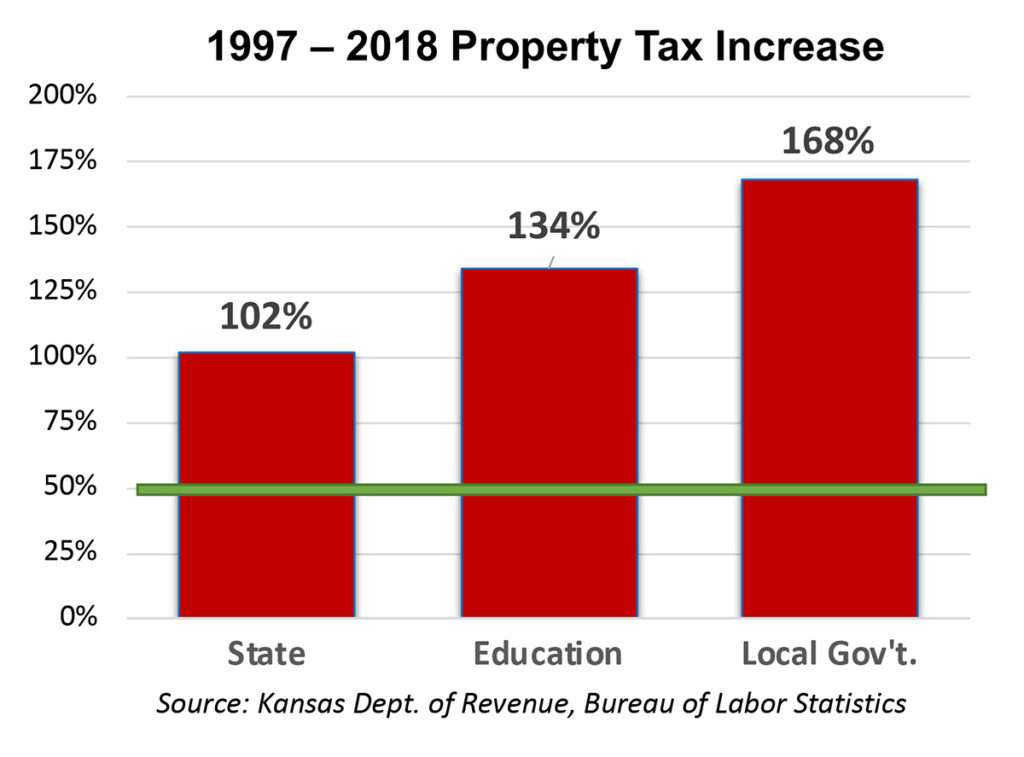

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

States With Highest And Lowest Sales Tax Rates